Ways to qualify for the EB-5 Investment Amount and secure your U.S. Visa

EB-5 Visa Explained: How to Get a Visa Via Financial Investment

The EB-5 Visa program provides a distinct opportunity for international investors looking for united state irreversible residency via an organized financial investment strategy. With certain eligibility standards and investment limits, the process requires cautious factor to consider and critical planning. Recognizing the nuances of the application procedure, including the distinctions between local centers and direct financial investments, is necessary for prospective candidates. As this pathway unfolds, potential financiers must navigate numerous benefits and obstacles that accompany it. What are the crucial variables that can affect the success of an EB-5 application?

Introduction of EB-5 Visa

The EB-5 Visa program, created to boost the U.S. economic climate via international investment, provides a path to permanent residency for eligible capitalists and their family members. Established by the Immigration Act of 1990, the program intends to bring in foreign funding to produce work and enhance financial growth in the United States. Capitalists who contribute a minimum quantity to an accepted job can request this visa, therefore enabling them to buy various markets, including realty, facilities, and other business ventures.

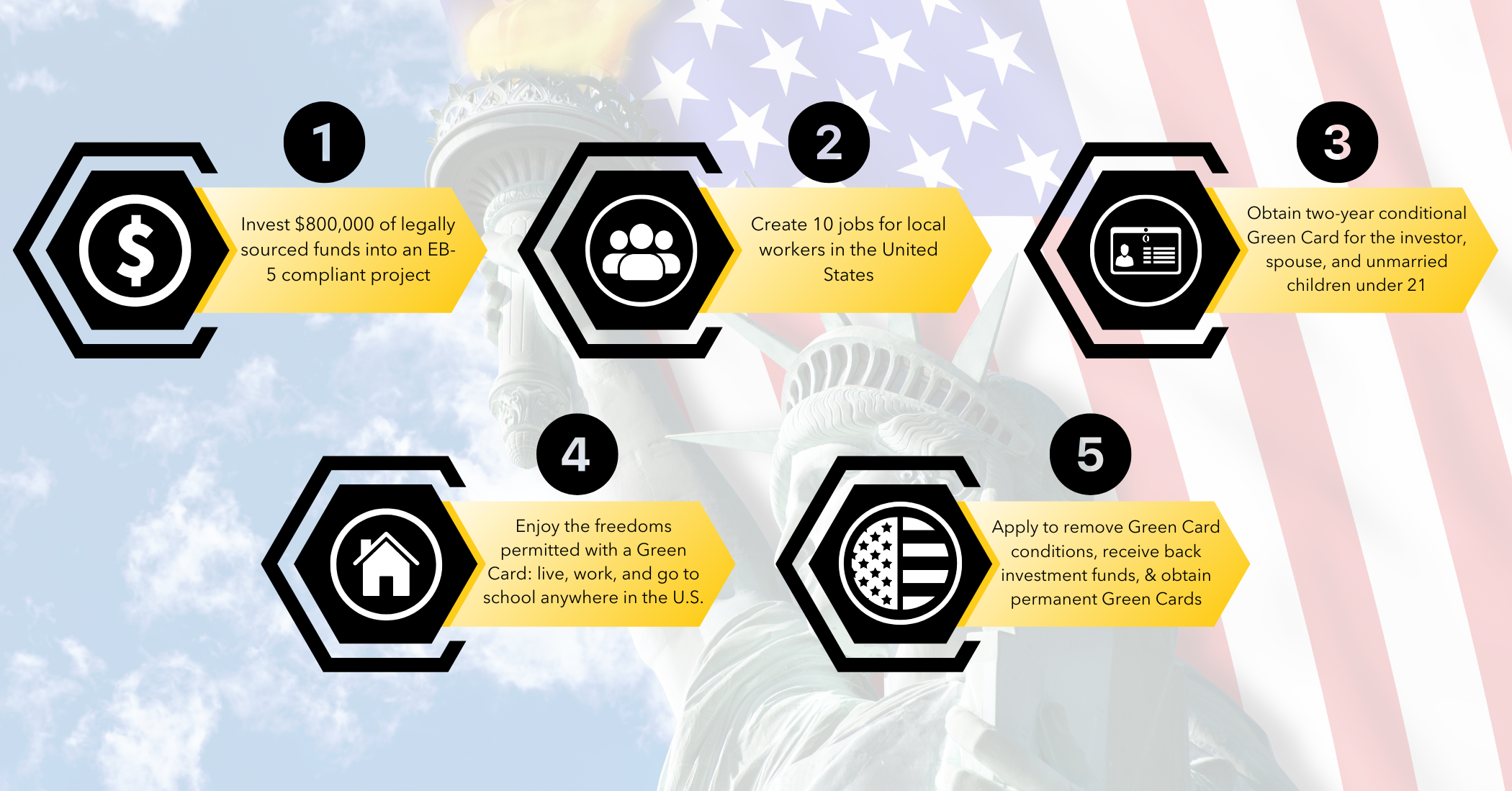

The EB-5 program is specifically appealing due to its twin advantages: a possibility for economic rois and the potential for U.S. citizenship. By purchasing targeted employment locations (TEAs), which are defined as rural areas or locations with high joblessness, capitalists may qualify for a minimized financial investment limit. The program calls for the creation of a minimum of ten full-time tasks for U.S. workers as a direct result of the investment. Successful applicants receive a conditional visa for 2 years, after which they can use for long-term residency, supplied they meet all program requirements. This path has gathered interest from financiers internationally, making it a vital component of united state migration plan.

Eligibility Criteria

To get the EB-5 Visa, capitalists need to meet particular qualification standards that guarantee their investment adds to job development and financial growth in the USA - EB-5. Candidates need to invest a minimum of $1 million in a brand-new business venture, or $500,000 if the investment is made in a targeted work area (TEA), which is normally defined by high unemployment or rural areas.

In addition, the venture has to maintain or develop a minimum of 10 full time work for certifying U.S. employees within two years of the financier's admission to the United States. Investors are additionally called for to demonstrate that their financial investment funds were obtained through lawful ways, offering evidence such as tax obligation returns and bank statements.

One more essential requirement is that the investment should be in a for-profit company entity that was established after November 29, 1990, or one that has been reorganized or increased to satisfy the EB-5 requirements. Candidates must demonstrate their intent to actively take part in the company, guaranteeing that their involvement contributes to its success. Meeting these eligibility requirements is important for investors looking for to acquire long-term residency via the EB-5 program.

Investment Options

When thinking about the EB-5 visa, capitalists have to examine their options between direct financial investment possibilities and local center programs. Each option lugs specific work development requirements that are crucial for fulfilling the visa criteria. Comprehending these financial investment avenues is vital for making a notified choice that lines up with both monetary objectives and migration objectives.

Direct Financial Investment Opportunities

Straight investment chances under the EB-5 Visa program supply international investors with a pathway to acquire united state irreversible residency while adding to the American economy. Unlike local center investments, direct investments require financiers to actively handle their service ventures within the U.S., enabling for potential higher control and influence over their investment end results.

To get approved for the EB-5 Visa with straight financial investment, international nationals should invest a minimum of $1 million in a brand-new business or $500,000 in a targeted employment area, which is defined as a rural location or an area with high unemployment. The investment needs to cause the production of at the very least ten full-time work for certifying united state employees within two years.

Direct financial investment choices can vary widely, including sectors such as real estate development, production, innovation, and friendliness start-ups. Investors must carry out comprehensive due diligence to analyze the feasibility of their picked business design and assurance compliance with EB-5 regulations. Involving with financial and legal specialists experienced in EB-5 matters is a good idea to navigate the intricacies of direct investment chances and optimize the possibility for a successful application.

Regional Center Programs

Leveraging the EB-5 Visa program, local facility programs provide a structured investment avenue for international nationals seeking U.S. irreversible residency. These programs are assigned by the U.S. Citizenship and Immigration Solutions (USCIS) and focus on merging investments to money various financial development projects, which might include actual estate, infrastructure, and organization enterprises.

Investors usually add a minimum of $900,000 in targeted work locations or $1.8 million in various other regions. EB-5 Investment Amount. One of the major advantages of regional center programs is that they allow investors to fulfill the EB-5 investment demands through indirect job development, as opposed to direct work creation required in direct financial investment possibilities

Regional centers manage the investment in behalf of the investors, supplying a much more passive method than straight investment. This monitoring consists of managing job development, economic reporting, and compliance with USCIS regulations. In addition, regional facilities frequently have developed performance history, improving the confidence of possible investors.

Ultimately, local center programs offer a compelling choice for those looking to navigate the complexities of the EB-5 Visa process while adding to united state financial growth and job creation.

Work Creation Needs

To qualify for an EB-5 Visa, capitalists need to confirm that their capital financial investment causes the development of a minimum of ten permanent jobs for united state workers within 2 years. This job creation requirement is an essential component of the EB-5 program, developed to boost the U.S. economic climate and advertise economic development.

Investors can select between 2 main investment alternatives: straight financial investments and financial investments via Regional Centers. With direct investments, the capitalist must proactively manage the company and assurance task production, while additionally showing that the work developed are for U.S. people or authorized permanent residents. Alternatively, Regional Facility investments enable financiers to pool their sources right into a marked task, often resulting in indirect job production, which can be counted in the direction of satisfying the task demand.

To efficiently meet the job production standards, it is very important for capitalists to work very closely with experienced professionals who can assist them through the intricacies of the EB-5 program. Appropriate planning and adherence to laws are important to verify conformity and protect a course to permanent residency. Failure to satisfy these work production demands can threaten the financier's EB-5 application and their immigration condition.

The Application Process

The application procedure for the EB-5 visa entails a series of crucial actions and specific eligibility requirements that applicants should satisfy. Understanding these standards is vital for an effective application. This area will certainly detail the necessary qualifications and give a detailed guide to guiding via the procedure.

Qualification Requirements Introduction

Understanding the eligibility requirements for the EB-5 visa is essential for possible capitalists aiming to obtain irreversible residency in the United States. To qualify, a private have to show a minimum financial investment of $1 million in a brand-new business, or $500,000 if the investment is made in a Targeted Employment Area (TEA), which is defined as a backwoods or one with high joblessness.

The investor has to show that the financial investment will certainly create or preserve at the very least 10 full-time work for U.S. workers within 2 years of the investment. The business should also be a for-profit entity and should be freshly established or substantially redesigned if it is an existing organization.

The candidate has to verify that the financial investment funds are obtained via legal methods, consisting of individual financial savings, gifts, or loans supported by proper documentation. On top of that, the financier needs to actively join business, ensuring their involvement in the monitoring of the venture. Fulfilling these eligibility requirements is important for an effective EB-5 application and inevitably safeguarding an environment-friendly card via this financial investment opportunity.

Step-by-Step Procedure

As soon as eligibility needs are satisfied, prospective capitalists can start the application process for the EB-5 visa. The initial step involves completing Form I-526, the Immigrant Request by Alien Investor. This kind has to be accompanied by supporting documents that shows the financier's qualifying financial investment and the production of at least 10 permanent jobs for U.S. workers.

Upon authorization of Form I-526 by the USA Citizenship and Migration Solutions (USCIS), investors can apply for the EB-5 visa via either consular processing or change of standing, relying on their existing residency. For those outside the united state, this indicates submitting a visa at a united state consulate. Conversely, if currently in the united state, applicants should file Kind I-485, Application to Register Permanent Home or Adjust Condition.

After authorization, capitalists and their eligible family participants receive conditional long-term residency for 2 years. Within 90 days before the expiry of this conditional status, investors have to submit Form I-829, Request by Entrepreneur to Eliminate Problems, to acquire permanent residency. Successful conclusion of this action wraps up the EB-5 financial investment process, providing the financier a Visa.

Regional Centers vs. Direct Investments

Navigating the EB-5 visa program includes a crucial choice in between direct financial investments and local facilities, each offering distinct pathways to acquiring long-term residency in the United States - EB-5 Visa by Investment. Regional centers are designated by the USA Citizenship and Immigration Solutions (USCIS) to promote financial growth via task creation. When spending through a local facility, capitalists normally add to a pooled fund, which is managed by the. This option frequently enables an extra easy investment technique, as the center oversees the task and work production requirements

In comparison, straight financial investments require capitalists to proactively handle their own company ventures in the United States. This technique demands a more hands-on participation, as the capitalist should produce and sustain a minimum of 10 full-time tasks straight relevant to their business. While straight investments might provide higher control over the investment end result, they also require greater risks and responsibilities.

Ultimately, the option between direct financial investments and regional centers hinges on individual danger resistance, wanted participation degree, and investment goals. Comprehending these distinctions is important for investors seeking to navigate the intricacies of the EB-5 visa program effectively.

Benefits of the EB-5 Visa

The EB-5 visa program provides numerous advantages for international financiers looking for irreversible residency in the United States. One of the most considerable benefits is the chance for financiers and their immediate member of the family, consisting of spouses and kids under 21, to get an environment-friendly card, approving them the right to work and live in the united state indefinitely.

The EB-5 program does not call for an enroller, permitting capitalists greater autonomy in their immigration trip. This program also supplies a path to citizenship after five years of long-term residency, facilitating long-lasting security for families. Additionally, investing with assigned Regional Centers can be less cumbersome, as these entities frequently manage the task and job development requirements on behalf of the financier.

Moreover, the EB-5 visa can cause substantial financial returns, as financial investments are normally guided toward business ventures that can produce profits. Ultimately, by adding to financial development and job development in the U.S., EB-5 capitalists play an important duty in boosting regional areas. In general, the EB-5 visa acts as a compelling choice for those wanting to safeguard a future in the USA while making a favorable influence.

Typical Challenges and Factors To Consider

While the EB-5 visa program offers eye-catching benefits for foreign capitalists, it also includes its share of difficulties and factors to consider that prospective candidates must carefully assess. One significant difficulty is the monetary dedication included, as the minimum investment quantity is significant, commonly set at $1 million or $500,000 in targeted work areas. Financiers have to ensure that they have sufficient funding and a clear understanding of the connected threats.

Prospective capitalists should perform comprehensive due persistance on the investment jobs to prevent fraudulent plans. The success of an EB-5 application rests on the development of at the very least 10 full time jobs for united state workers, demanding cautious preparation and surveillance of business's performance (EB-5 Investment Amount). Eventually, navigating these difficulties requires a tactical method and often the advice of skilled specialists in migration and financial investment legislation

Regularly Asked Inquiries

How much time Does the EB-5 Visa Process Typically Take?

Can Family Members Members Apply With the Primary EB-5 Candidate?

Yes, check out this site family members can use along with the key applicant. EB-5 Visa by Investment. Qualified dependents commonly consist of spouses and unmarried children under 21, enabling them to get environment-friendly cards contingent upon the key candidate's successful visa approval

What Takes place if My Financial Investment Falls short?

It may threaten your migration condition and the possibility for obtaining an eco-friendly card if your investment falls short. It's essential to carry out detailed due diligence and consider threat reduction approaches prior to continuing with any kind of financial investment.

Are There Age Restrictions for EB-5 Investors?

There are no specific age limitations for EB-5 capitalists; however, the private must go to least 18 years of ages to lawfully enter into investment contracts. Minors may certify through adult investment and sponsorship.

Can I Traveling Outside the United State During the Application Process?

Traveling outside the united state throughout the application procedure may influence your status. It is advisable to consult with a migration attorney to comprehend potential risks and warranty compliance with all needs while your application is pending.

Regional focuses handle the financial investment on behalf of the financiers, providing an extra passive strategy than direct financial investment. To qualify for an EB-5 Visa, capitalists should validate that their capital financial investment results in the creation of at least 10 full time work for U.S. employees within 2 years. Investors can pick between two key financial investment options: straight financial investments and financial investments via Regional Centers. The capitalist needs to reveal that the financial investment will certainly develop or protect at least 10 full-time tasks for United state workers within two years of the financial investment. Ultimately, the option in between direct investments and regional facilities pivots on specific threat tolerance, preferred participation degree, and financial investment goals.